Financial services share in India’s market capitalisation increased to 24% in FY21 from ~6% in FY01. India has a diversified financial sector undergoing rapid expansion, both in terms of strong growth of existing financial services firms and new entities entering the market.

In Australia, the financial services sector is a key contributor to the country’s economy, accounting for a significant share of GDP and employment. The sector includes banking, insurance, superannuation, and funds management. Australian firms might form alliances with Indian financial services firms in industries where they have comparative advantages.

SOLID DEMAND:

- Investment corpus in Indian insurance sector might rise to US$ 1 trillion by 2025.

- With >2,100 fintechs operating currently, India is positioned to become one of the largest digital markets with rapid expansion of mobile and internet.

- Rising income is driving the demand for financial services across income brackets.

DRIVING ADVANTAGE:

- In the Union Budget 2022-23 India announced plans for a central bank digital currency (CBDC) which will be known as Digital Rupee.

- India benefits from a large cross-utilisation of channels to expand reach of financial services.

GOVERNMENT POLICIES:

- The government has approved 100% FDI for insurance intermediaries and increased FDI limit in the insurance sector to 74% from 49% under the Union Budget 2021-22.

- In September 2021, the international branch of the National Payments Corporation of India (NPCI), NPCI International Payments (NIPL), has teamed with Liquid Group, a cross-border digital payments provider, to enable QR-based UPI payments to be accepted in 10 countries in north and southeast Asia.

RISE IN INVESTMENTS:

- HNWI participation is growing in the wealth management segment.

- Credit, insurance and investment penetration is rising in rural areas.

- Lower mutual fund penetration of 5-6% reflects latent growth opportunities.

INTRODUCTION

The sector comprises commercial banks, insurance companies, non-banking financial companies, co-operatives, pension funds, mutual funds and other smaller financial entities. The banking regulator has allowed new entities such as payment banks to be created recently, thereby adding to the type of entities operating in the sector. India has a diversified financial sector undergoing rapid expansion, both in terms of strong growth of existing financial services firms and new entities entering the market.

The Government of India has introduced several reforms to liberalise, regulate and enhance this industry. The Government and Reserve Bank of India (RBI) have taken various measures to facilitate easy access to finance for Micro, Small and Medium Enterprises (MSMEs). These measures include launching Credit Guarantee Fund Scheme for MSMEs, issuing guidelines to banks regarding collateral requirements and setting up a Micro Units Development and Refinance Agency (MUDRA). With a combined push by Government and private sector, India is undoubtedly one of the world’s most vibrant capital markets.

MARKET DIMENSIONS

In FY23 (until May 2022) non-life insurance sector premiums reached at Rs. 36,680.69 crore (US$ 4.68 billion). Another crucial component of India’s financial industry is the insurance industry. The insurance industry has been expanding at a fast pace. The total first-year premium of life insurance companies reached US$ 40.1 billion in FY22.

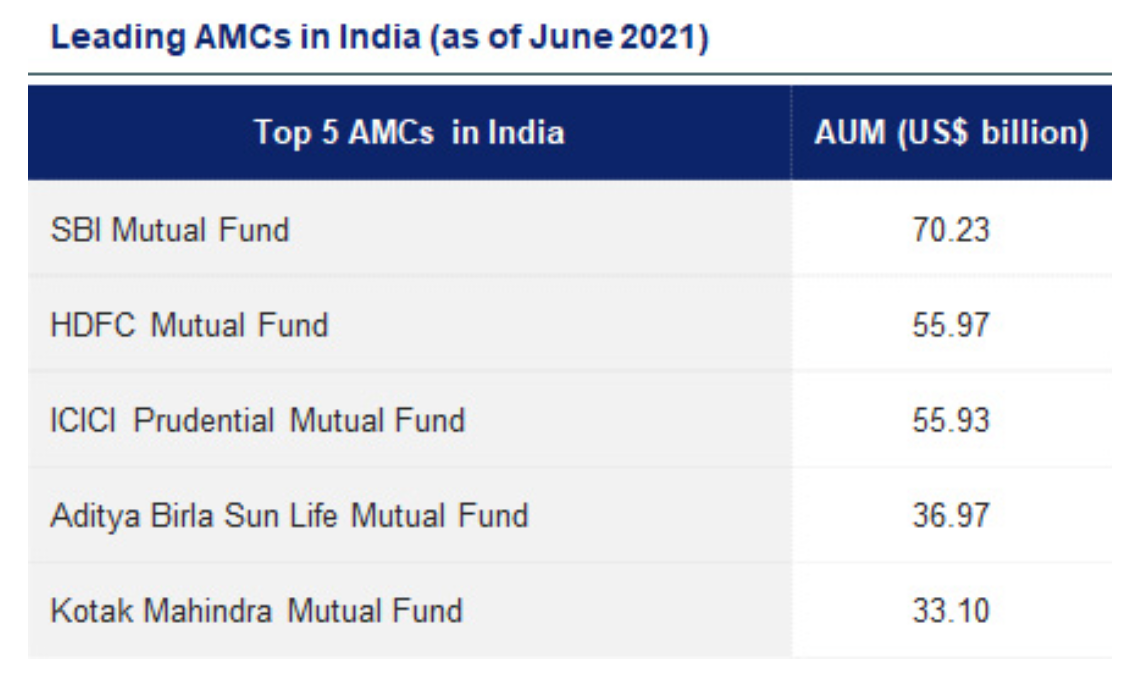

As of October 2022, AUM managed by the mutual fund industry stood at Rs. 39.50 trillion (US$ 483.63 billion), and the total number of accounts stood at 139.1 million. Inflow in India’s mutual fund schemes via systematic investment plan (SIP) stood at Rs. 87,275 crore (US$ 10.68 billion). Furthermore, India’s leading bourse, Bombay Stock Exchange (BSE), will set up a joint venture with Ebix Inc to build a robust insurance distribution network in the country through a new distribution exchange platform. In FY22, US$ 14.55 billion was raised across 127 initial public offerings (IPOs). The number of companies listed on the NSE increased from 135 in 1995 to 2,012 by FY22.

INVESTMENTS AND GROWTH

The Financial Services Industry has seen major achievements in the recently:

• In November 2022, Unified Payments Interface (UPI) recorded 7.30 billion transactions worth Rs. 12.11 trillion (US$ 148.63 billion).

• The number of transactions through immediate payment service (IMPS) reached 482.46 million (by volume) and amounted to Rs. 4.66 trillion (US$ 57.05 billion) in October 2022.

GOVERNMENT POLICIES

Some major Government actions are:

On September 30, 2021, the Reserve Bank of India communicated that the applicable average base rate to be charged by non-banking financial company – micro finance institutions (NBFC- MFIs) to their borrowers for the quarter beginning October 1, 2021, will be 7.95%.

In September 2021, the international branch of the National Payments Corporation of India (NPCI), NPCI International Payments (NIPL), has teamed with Liquid Group, a cross-border digital payments provider, to enable QR-based UPI payments to be accepted in 10 countries in north and southeast Asia.

On September 30, 2021, the IFSC Authority constituted an expert committee to recommend approach towards development of sustainable finance hub and provide road map for the same.

THE FUTURE AHEAD

Today India is one of the most vibrant global economies on the back of robust banking and insurance sectors. The relaxation of foreign investment rules has received a positive response from the insurance sector, with many companies announcing plans to increase their stakes in joint ventures with Indian companies. Over the coming quarters, there could be a series of joint venture deals between global insurance giants and local players.

India’s financial services industry has experienced huge growth in the past few years. This momentum is expected to continue. India’s private wealth management Industry shows huge potential. India is expected to have 6.11 lakh HNWIs by 2025. This will indeed lead India to be the fourth largest private wealth market globally by 2028. India’s insurance market is also expected to reach US$ 250 billion by 2025.

According to Goldman Sachs, investors have been pouring money into India’s stock market, which is likely to reach >US$ 5 trillion, surpassing the UK, and become the fifth-largest stock market worldwide by 2024.

India’s Fintech space is expected to further fuel this growth in various segments. India’s mobile wallet industry is estimated to grow at a Compound Annual Growth Rate (CAGR) of 150% to reach US$ 4.4 billion by 2022, while mobile wallet transactions will touch Rs. 32 trillion (USD$ 492.6 billion) during the same period.

The Australian government has implemented several reforms to improve consumer protection and promote competition in the financial services sector. Technological advancements have also impacted the sector, with the growth of fintech companies and the adoption of digital banking services. The financial services sector is a key contributor to the country’s economy, accounting for a significant share of GDP and employment. The sector includes banking, insurance, superannuation, and funds management. The institutional investment sector in Australia is focused on quick victories and rewards that are counterproductive to India’s value offer. It will assist if India’s economic environment, sovereign government structures, and literacy levels improve.