India is the second largest mobile handsets manufacturer in the world with regard to the volume produced, amounting to 30 crores (300 million) in FY21. India’s telecom sector is the second largest globally concerning the subscriber base.

The telecommunications sector is one of the fastest growing areas in the electronics and telecommunications industry in Australia. There are many opportunities available in this sector for professionals with skills in network engineering, software development, and data analysis.

SOLID DEMAND:

- Tele-density of rural subscribers reached 44.40% in December 2021. From around 4,200 petabytes in 2018, India's overall wireless internet data usage has increased by almost 7x to 32,397 petabytes in 2021. telecom sector is the second largest globally with regard to subscriber base.

- Will be the fifth-largest consumers of electronic products by 2025.

DRIVING ADVANTAGE:

- Addressable market for domestic OEMs is projected to be >Rs. 10 lakh crore (US$ USD 131.99 billion) by 2025.

- By 2025, India will need ~22 million skilled workers in 5G-centric technologies such as Internet of Things (IoT), Artificial Intelligence (AI), robotics and cloud computing.

GOVERNMENT POLICIES:

- The Union Cabinet approved Rs. 12,195 crore (US$ 1.65 billion) production-linked incentive (PLI) scheme for telecom & networking products under the Department of Telecom.

- The electronics sector is expected to nearly double in contribution to the GDP in the next few years, owing to increased support from the government to domestic manufacturing.

RISE IN INVESTMENTS:

- FDI inflows in the Electronics and Electrical Equipments reached US$ 14.76 billion between April 2000-June 2022.

- In Union Budget 2022-23 the Department of Telecommunications was allocated Rs. 84,587 crore (US$ 11.11 billion). Revenue expenditure was allocated 36% and capital expenditure 64%.

INTRODUCTION

India is the world’s second-largest telecommunications market with a subscriber base of 1.16 billion and has registered strong growth in the last decade. The Indian mobile economy is growing rapidly and will contribute substantially to India’s Gross Domestic Product (GDP) according to a report prepared by GSM Association (GSMA) in collaboration with Boston Consulting Group (BCG). The deregulation of Foreign Direct Investment (FDI) norms have made the sector one of the fastest-growing and the top five employment opportunity generator in the country.

The deregulation of Foreign Direct Investment (FDI) norms have made the sector one of the fastest-growing and the top five employment opportunity generator in the country. India witnessed a substantial spike in demand for electronic products in the last few years; this is mainly attributed to India’s position as second-largest mobile phone manufacturer worldwide and surge in internet penetration rate. The Government of India attributes high priority to electronics hardware manufacturing, as it is one of the crucial pillars of Make in India, Digital India and Start- up India programmes. The Electronics System Design & Manufacturing (ESDM) sector plays a vital role in the government’s goal of generating US$ 1 trillion of economic value from the digital economy by 2025.

MARKET DIMENSIONS

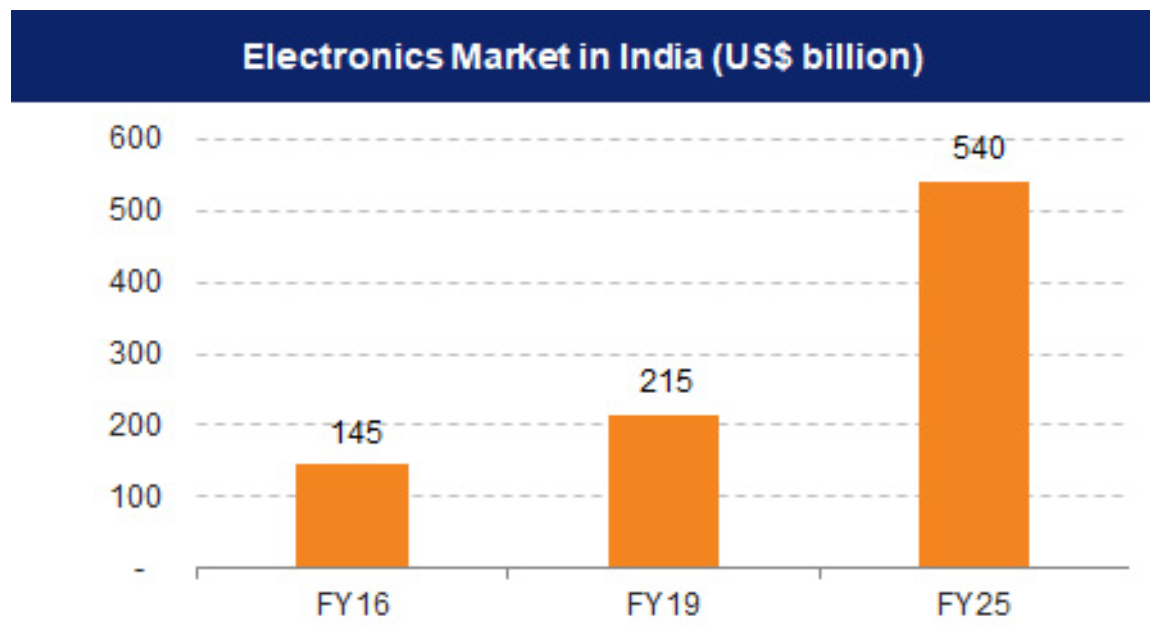

In India, smartphone shipments from India crossed 168 million units in CY 2021, and in 2022, smartphone shipments from India are expected to reach ~190 million. 5G device shipments are expected to increase by 129% YoY, from 28 million in CY 2021 to about 64 million in CY 2022. Electronics design segment, growing at 20.1%, was 22% of the ESDM market size in FY19; it is anticipated to be 27% of the ESDM market size in FY25. The Indian electronics manufacturing industry is projected to reach US$ 520 billion by 2025. The demand for electronic products is expected to rise to US$ 400 billion by 2025 from US$ 33 billion in FY20.Electronics system market is expected to witness 2.3x demand of its current size (FY19) to reach US$ 160 billion by FY25.

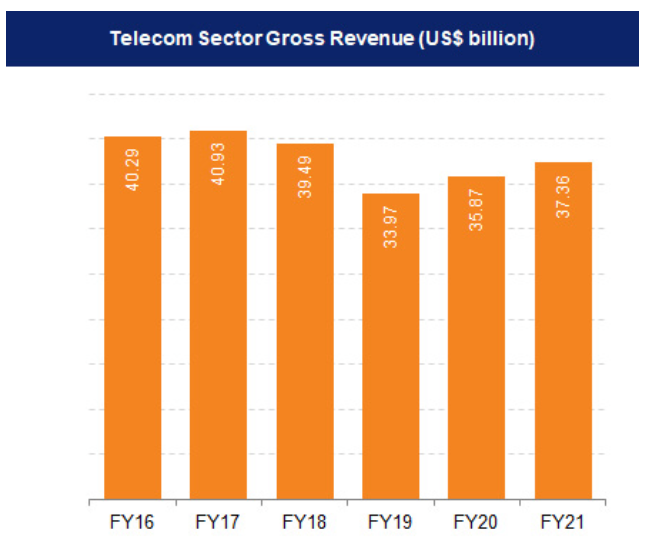

India is the world’s second-largest telecommunications market. The total subscriber base, wireless subscriptions as well as wired broadband subscriptions have grown consistently. Tele- density stood at 84.88%, as of April 2022, total broadband subscriptions grew to 788.77 million until April 2022 and total subscriber base stood at 1.16 billion in April 2022.

By 2025, India will need ~22 million skilled workers in 5G-centric technologies such as Internet of Things (IoT), Artificial Intelligence (AI), robotics and cloud computing.

INVESTMENTS AND GROWTH

Some of the investments/ developments in the Electronics and Telecommunication are as follows:

In November 2022, Voltas entered into a technology license agreement with Denmark’s Vestfrost Solutions to develop, manufacture, sell and service medical refrigeration and vaccine storage equipment including ice lined refrigerators, vaccine freezers and ultra-low temperature freezers to the India market.

FDI inflows in the Electronics and Electrical Equipments reached US$ 14.76 billion between April 2000-June 2022 and in Telecom sector it stood at US$ 39.02 billion between April 2000- September 2022.

Exports of electronic goods stood at US$ 2,009.07 million in September 2022 and Imports of electronics goods stood at US$ 7,142.3 million in September 2022.

In January 2022, Google made a US$ 1 billion investment in Airtel through the India Digitization Fund.

In October 2021, Vodafone Idea stated that it is in advanced talks to sell a minority stake to global private equity investors including Apollo Global Management and Carlyle to raise up to Rs. 7,540 crore (US$ 1 billion) over the next 2-3 months.

GOVERNMENT POLICIES

Some of the major Government policies are:

In Union Budget 2022-23 the Department of Telecommunications was allocated Rs. 84,587 crore (US$ 11.11 billion) out of which Rs. 30,436 crore (US$ 3.99 billion) was revenue expenditure which was 36% of the total expenditure and Rs. 54,150 crore (US$ 7.11 billion) was capital expenditure which is 64.01% of total expenditure.

To drive the development of 6G technology, the Department of Telecommunications (DoT) has developed a sixth generation (6G) innovation group.

FDI cap in the telecom sector has been increased to 100% from 74%; out of 100%. In October 2021, the government notified 100% foreign direct investment (FDI) via the automatic route from previous 49% in the telecommunications sector. FDI of up to 100% is permitted for infrastructure providers offering dark fibre, electronic mail and voice mail.

As per Union Budget 2022-23, the Ministry of Electronics and Information Technology (MeitY) has been allocated Rs. 14,300 crore (US$ 1.85 billion).

About 80% of the Production-Linked Incentive scheme (PLI) to encourage manufacturing in the country, which covers 14 industries and has a total investment of Rs 3 lakh crore (US$ 38.99 billion), is concentrated in only three sectors: electronics, automobiles, and solar panel production.

A fund of Rs. 3.2 crore (US$ 433.46 thousand) for three years has been approved by the Department of Electronics, IT, BT, Science & Technology.

THE FUTURE AHEAD

In India, Sony, Samsung, LG Electronics, Panasonic, and other companies are the market leaders in ESDM sector. Government efforts are concentrated on bridging the digital gap. Projects like “Digital India,” “Smart Cities,” “ePanchayats,” “National Optical Fiber Network,” etc. enhanced consumer demand for electronic goods around the nation. India’s middle class is rapidly expanding, which has improved the affordability of electronics products. According to a Zenith Media survey, India is expected to become the fastest-growing telecom advertisement market, with an annual growth rate of 11% between 2020 and 2023. The Indian Government is planning to develop 100 smart city projects, and IoT will play a vital role in developing these cities. Fuelled by strong policy support, huge investments by public and private stakeholders and a spike in demand for electronic products, the ESDM sector in India has bright prospects ahead of it and is predicted to reach US$ 220 billion by 2025, expanding at 16.1% CAGR between 2019 and 2025.

The future of the electronics and telecommunications sector in Australia looks promising, as the country continues to invest in advanced technologies and infrastructure to support the growing demand for digital connectivity and innovation. The National Broadband Network (NBN) is a government-owned company that is responsible for rolling out high-speed broadband across Australia. India is known for its expertise in software development, while Australia has a strong reputation for innovation in hardware design and system integration. This makes the two countries natural partners in developing new products and solutions that leverage both software and hardware technologies. Both India and Australia have established strong research and development capabilities in the electronics and telecommunications sector, and there is potential for collaboration between research institutions and businesses in both countries to drive innovation and create new opportunities. India and Australia have a strong foundation for collaboration in the electronics and telecommunications sector, with complementary capabilities and strengths that can be leveraged to create new opportunities for growth and innovation.